Did you know your Service Award gifts may not be taxable?

Bill retains tax exclusion for employee achievement awards

Unlike other awards/rewards such as points, gift cards and vouchers (which your employees must claim as taxable income), service and safety achievement awards when a part of a conforming plan are not considered a taxable benefit.

This valuable and important tax exclusion was at risk of being reversed by the U.S. Congress in December 2017. Thankfully, careful monitoring and calls to action by the Incentive Federation (IFI), Recognition Professionals International and their members ensured Section 274 (j) of the IRS Code pertaining to Employee Achievement Awards was retained.

Why mention?

We bring this up now as many organizations are unaware their Service Awards may be tax exempt or that this significant employee benefit was almost lost.

Tax law is not for the faint of heart so it’s not surprising many HR professionals are a little murky on what awards/rewards are taxable and tax exempt.

The awards in a conforming plan for service or safety achievement must be “tangible personal property” to be tax-exempt. The new bill aims to more clearly define what “tangible property” includes and what is considered a tax-exempt award. The language is summarized here:

“Tangible personal property shall not include cash, cash equivalents, gift cards, gift coupons or gift certificates (other than arrangements conferring only the right to select and receive tangible personal property from a limited array of such items pre-selected or pre-approved by the employer), or vacations, meals, lodging, tickets to theater or sporting events, stocks, bonds, other securities, and other similar items”.

This definition clarifies and provides more guidance, with no apparent change from past law.

Tax implications are just one reason why 86% of companies offer a length-of-service program.

Service awards are special.

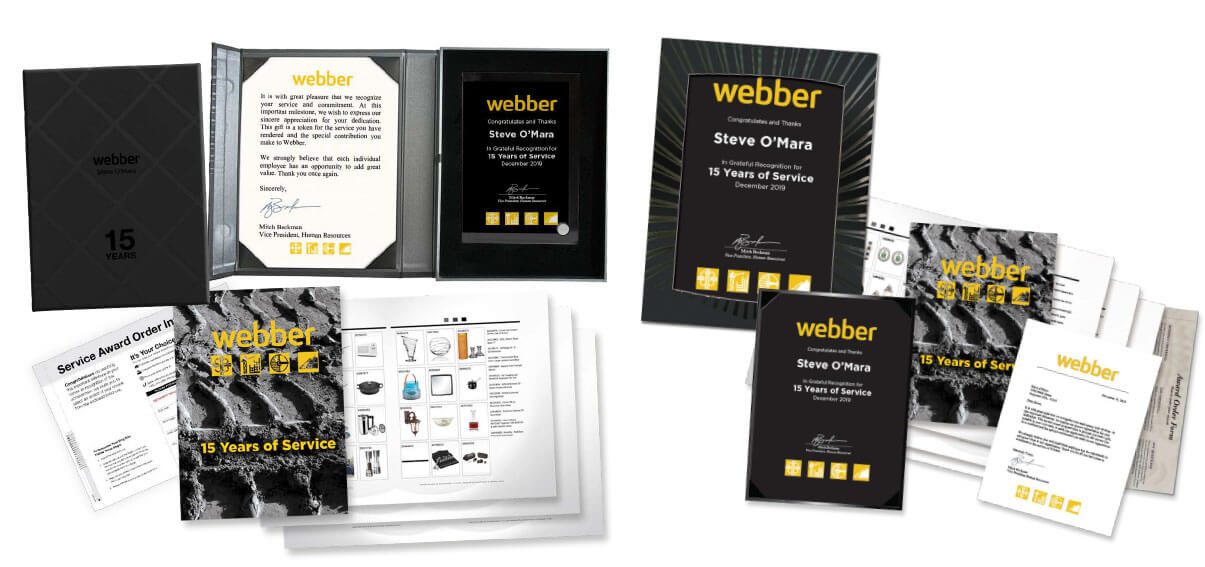

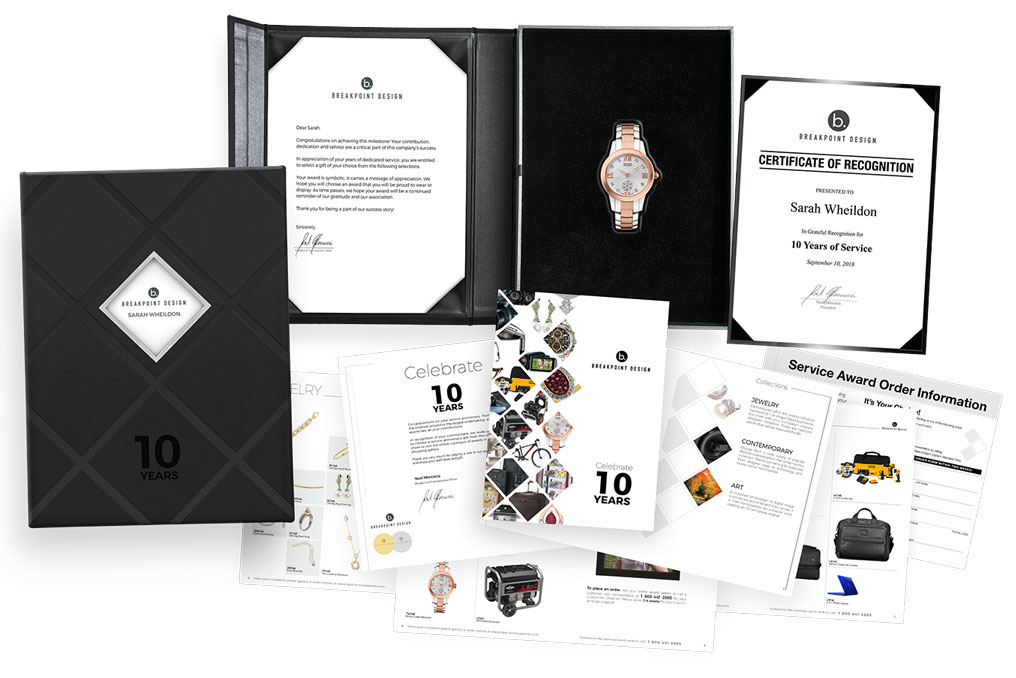

They provide an opportunity to demonstrate your people-first culture and create a sense of pride in work and company. Service awards are meant to be shared and celebrated together. Whether it’s to commemorate the first, third, fifth or twenty fifth year with the company, these milestones allow you to publicly reinforce your core values to individuals and their teams.

Check out our personalized Celebration packaging and gifts

Download our Guide to Giving an Effective Service Presentation

Still unsure what awards are taxable or exempt?

Unsure what a conforming service award plan is? As a member of Recognition Professionals International, our recognition and engagement professionals would be happy to provide a complimentary evaluation of your awards and answer any questions you have about the tax implications.

Contact us here or reach out to your local CSI STARS recognition partner.